Rolling Fund Weekly - Edition #5

Rolling In the Dough Edition: Will Venture Fund Management Fees Go To Zero?

Welcome to the fifth edition of Rolling Fund News, a weekly digest with updates and analysis of rolling funds and their wider impact on venture capital and early-stage investing. This week, we’re looking at “0% management fees” and investing in venture capital as an asset class.

We’ll see how management fees work in the traditional “2/20” fee structure, why management fees are so valuable in a zero interest-rate policy (ZIRP) environment, and the rise of venture funds with 0% management fees.

Don’t forget to subscribe to Rolling Fund News for the latest updates:

Venture Capital As An Asset Class 📈

Technology is deflationary, especially in financial markets. Robinhood’s $0 commissions changed the brokerage industry. Vanguard’s index funds made investing in the stock market accessible and affordable to millions of ordinary investors, saving them tens or even hundreds of billions of dollars in ‘insane costs’ and underperformance by active managers.

The major narrative of financial markets, over the past forty or fifty years, is always one of reducing costs and improving access for investors.

The major narrative of financial markets is always one of reducing costs and improving access for investors.

Will “0% management fees” similarly change the venture capital industry? It’s inevitable. Especially in the early stages, investing in seed and pre-seed deals, you’re going to see a lot of venture funds with near-zero management fees.

Ultimately, more competition and choice, as well as the technology infrastructure behind rolling funds, will bring costs down for venture investors. Investing in venture capital as an asset class will be facilitated by emerging venture funds with near-zero management fees.

How Most VCs Get Paid 🤑

First, here’s how the “2%” works in a traditional “2/20” fee structure. An emerging VC raises a small $10 million fund (“Fund I”) and locks in ten years of fixed, fee-based compensation. Often, these management fees are “front-loaded” to the early years, when the fund is actually making investments, and then drop down after a four- or five-year investment period or until a new fund is raised.

Let’s assume Fund I charges a 2% management fee. The VC gets paid an annual 2% management fee of committed capital ($10 million) for the investment period, and then an annual 2% management fee of invested capital (the active investments in Fund I portfolio companies) over the remaining life of Fund I, which is around ten years.

After a few years of investing, the emerging VC raises a second fund based on the reputation and unrealized returns of the Fund I portfolio. This $40 million fund (“Fund II”) is larger than Fund I, so the VC locks in yet another ten-year period of higher management fees, along with the remaining six or seven years of fees from Fund I, which is now in “maintenance” mode.

Finally, after raising a couple more $100 million funds (“Fund III” and “Fund IV”), the emerging VC has locked in nearly a career’s worth of fixed management fees. The VC has closed $250 million across Funds I through IV, and gets paid around $4 million per year, regardless of investment activity or fund performance. Notably, even if Fund I significantly outperforms, the dollar-weighted performance of Funds II, III, and IV may still result in underperformance for LPs invested across all four funds.

Even if Fund I significantly outperforms, the dollar-weighted performance of Funds II, III, and IV may still result in underperformance for LPs invested across all four funds.

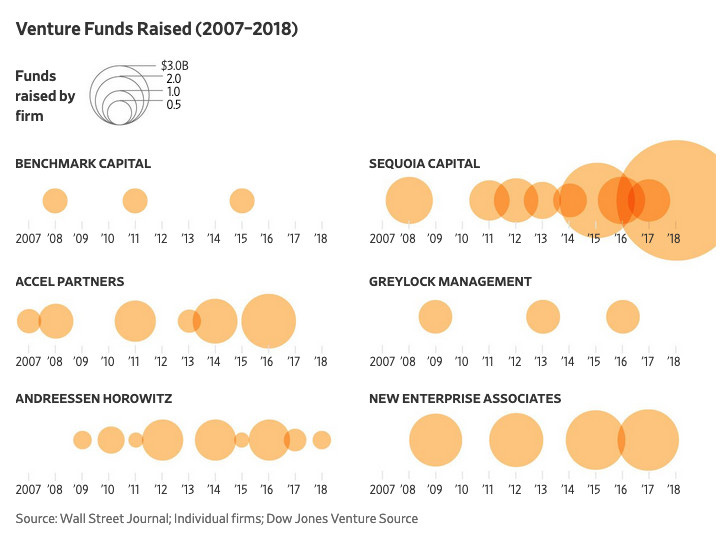

This trend in venture capital is confirmed by firms raising larger and larger “growth” funds to capitalize on companies staying private longer. The best-performing venture capital firms are regularly raising new funds every few years.

Why Management Fees Are So Valuable 💰

Fee-based compensation is predictable revenue. This revenue stream is extremely valuable in an investing environment where “risk-free” interest rates are effectively zero. (As of September 2020, the benchmark 10-year U.S. Treasury yield is barely 70 bps, or less than one percent.) By contrast, carry is sporadic and uncertain, “lumpy” and directly tied to a fund’s long-term performance. Since companies are staying private much longer (see our edition on rolling funds and SPACs for why this is happening), the emerging VC in our previous example may not earn significant carry for over a decade.

This revenue stream is extremely valuable in an investing environment where “risk-free” interest rates are effectively zero.

Fee-based compensation works for asset managers, not investors. For all but the smallest (or most successful) venture funds, partners stand to make more from fixed management fees than performance-based compensation. This lopsided fee structure is probably the greatest source of incentive misalignment between LPs and VCs.

The Rise Of “No-Fee” Venture Funds 🎢

Fee-based compensation isn’t really material for emerging fund managers. Let’s look at an example rolling fund to see why:

$2 million in capital commitments per quarter;

Management fees of 2% per annum over a ten-year period, payable quarterly over the first four years;

Minimum GP commit of 2.5%, or equivalent to $200,000 per year;

“Recycle” fees, or 80% of management fees reinvested back into the fund.

This is equivalent to maybe around $75,000 per year in fee-based compensation for the first four years, after admin fees and reinvestment. Not exactly a bonanza. With a significant GP commit and the majority of management fees reinvested back into the fund, the incentives for some rolling fund managers are pretty much aligned already.

With a significant GP commit and the majority of management fees reinvested back into the fund, the incentives for some rolling fund managers are pretty much aligned already.

Don’t Forget To Ask About The “GP Commit” 💪

Founders, when you receive multiple terms sheets, ask your VC, “How much of the fund is GP capital?” When you raise money, you should take term sheets from investors with the most “skin in the game,” since their interests will be the most rationally aligned with your own. GPs commit some capital to the funds they manage, but this commitment may only be around one percent for some venture funds.

What are the advantages of 0% management fees? These are very “LP-friendly” terms, especially for first-time LPs. It strongly aligns the incentives between LPs and fund managers to do well. The best early-stage investors aren’t motivated by management fees. They’re motivated to find great companies and invest in them.

The best early-stage investors aren’t motivated by management fees. They’re motivated to find great companies and invest in them.

What do 0% management fees mean in practice? The typical “fee load” for a venture fund with 2% management fees over a ten-year period is around fifteen percent, or $1.5 million paid out over ten years on a $10 million fund. This means the typical venture fund only invests 80 to 85 cents for every dollar of raised capital.

The equivalent “no-fee” venture fund with 0% management fees can invest in about 25% more companies ($1 vs. 80 cents) and make follow-on investments with 25% more capital. This isn’t an insignificant amount. Management fees can have a material effect on fund returns.

Does this mean every VC should get rid of management fees? Professional investors will continue to operate funds successfully with management fees, although these fees may decline due to competition. For one, there are very legitimate operational costs covered by some these fees (e.g. office space, legal and regulatory filings, an executive assistant, Zoom Meetings subscription).

For emerging GPs, who either don’t have a track record or are just getting started as fund managers, it makes sense to have 0% management fees and rely on a “carry-only” fee structure in the beginning, minus the de minimis admin fees, to get the fund rolling.

How do VCs that earn zero in management fees pay for things like mortgages and childcare? LPs understand that professional investors worried about making mortgage payments are probably not going to do their best work. Professional investors deserve the opportunity to earn an income, and funds should charge management fees accordingly for operational expenses.

However, not every emerging fund manager aspires to be a professional investor or full-time asset manager (at least, not initially). If you’re a founder or emerging GP starting out with a small fund, say, $1.25 million per quarter in capital commitments, the income from fee-based compensation isn’t really material to your success. You’re not working the management fees to get rich.

Will the “user-as-the-product” model we’ve come to hate with Facebook and Google come back to bite us with “no-fee” venture funds? It’s a familiar adage in technology circles: “If the service is provided for free, you’re not the customer. You’re the product.” Of course, a “no-fee” venture fund still earns carry, so this statement doesn’t apply here. If anything, the incentives between LPs (the “customer”) and fund managers (the “service”) are better aligned with a “carry-only” fee structure.

Thinking ahead, a “no-fee” venture fund may gather LPs and assets under management to serve as a marketing vehicle or some other purpose. If the “non-monetary” compensation for being a successful angel investor is valuable enough on its own (e.g. in improved social status, prestige, or societal impact), then “no-fee” venture funds will continue to proliferate. This social status effect, if it exists, is probably overestimated.

Disclaimer: This material should not be construed as a recommendation for any investment or other advice of any kind and shall not constitute or imply any offer to purchase, sell or hold any security or to enter into or engage in any type of transaction.

But i don't understand how the zero-fee model works given AngelList is charging 1.5% AUM.

So if you are a GP waiving your 2.5% management fee (perhaps by reinvesting your fee as GP commit to the fund), who is paying Angel List?